Most companies will have financial instruments in their portfolios. Their purpose is solely for capital appreciation and income.

Let us look into the accounting and tax treatment of these financial instruments. This article is the first part of a two-part discussion on this topic.

WHAT IS A FINANCIAL INSTRUMENT?

A financial instrument (FI) is any contract that gives rise to a financial asset for the holder and a financial liability or equity instrument for the issuer.

Financial assets could be in the form of debt securities and/or equity securities. A debt security represents an obligation that is normally covered by a loan agreement and bonds payable while an equity security refers to ownership in a company as evidenced by shares of stock. The issuer could be a domestic company, foreign corporation and even a Philippine or foreign government institution. It is important to note that financial assets can be traded on market or can be held to maturity to provide efficient cash flow through via interest or dividends.

HOW ARE FINANCIAL INSTRUMENTS MEASURED AND CLASSIFIED?

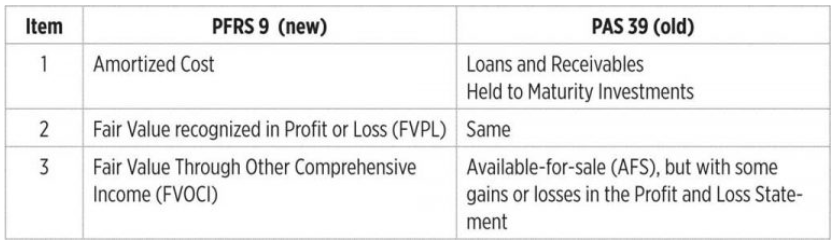

For accounting purposes, the financial instrument is covered by Philippine Financial Reporting Standards (PFRS) 9 which took effect on Jan. 1, 2018. PFRS 9 replaced Philippine Accounting Standards (PAS) 39 which governs the recognition and measurement of FIs. The new standard states that the Financial Assets may be classified and measured at amortized cost or fair value approach.

Below is the comparison of the categories of Financial Assets under the new and old standards:

In accordance with PFRS 9, a financial asset is classified and measured at amortized cost if the asset is held with the business model objective of holding financial assets to collect the contractual cash flows that represent “Solely for Payment of Principal and Interest” (SPPI) on the principal outstanding. Moreover, a financial asset is classified and subsequently measured at FVOCI if it meets the SPPI criterion and is held in a business model whose objective is achieved by both collecting contractual cash flows and selling the financial assets. All other financial assets are measured at FVPL. In addition, PFRS 9 allows entities to make an irrevocable election to present subsequent changes in the fair value of the equity instruments that is not held for trading in other comprehensive income.

Note, here that the new standard requires the assessment of the contractual cash flow characteristics to properly categorize the instrument under the above classification.

For tax purposes, FIs are always measured at the contracted amount or transaction value. Hence, any incidental costs in the acquisition of the instrument such as commission, broker’s fees or any taxes paid are to be recognized separately as an outright expense. The classification of the financial assets will fall either as a capital asset or as an ordinary asset.

Section 34 of the Tax Code, as amended, defines capital assets as properties held by the taxpayer whether or not connected with his trade or business, but not including:

a. Stock in trade of the taxpayer or other property of a kind which would properly be included in the inventory of the taxpayer if on hand at the close of the taxable year; and

b. Property held by the taxpayer primarily for sale to customers in the ordinary course of his trade or business.

Ordinary assets, on the other hand, are assets not classified as capital assets. It is important to note that the taxpayer should properly classify whether the FI is a capital or an ordinary asset since the treatment of the gain or loss on disposal of the FIs will have different tax consequences.

Here is a summary of the applicable tax treatments of the disposal of the FIs:

1. Gain from the sale of an FI classified as an ordinary asset is included as part of the taxable income subject to the regular corporate income tax while the loss from the sale is considered deductible in full from gross income.

2. Gain from the sale of an FI classified as a capital asset is also reported as part of the taxable income subject to the regular tax but the loss from the disposal of such capital asset is deductible only to the extent of the capital gain from such sales. However, the limitation of the deductibility of the capital loss does not apply to a bank or trust company incorporated in the Philippines.

3. Net gain from the sale of shares of stock of a domestic corporation not traded and listed through a local stock exchange, if considered as a capital asset, is not reportable for regular corporate income tax since the transaction will be separately subject to a final tax. If the seller is a domestic corporation, it is subject to 15% final tax. Should the seller be a non-resident foreign corporation (NRFC), the net gain is subject to 5% for the first P100,000 and 10% in excess of the first P100,000. The loss from the sale of this type of asset is deductible only to the extent of the gain of the similar assets. If the NRFC is a resident of a country with whom the Philippine has a tax treaty, the treaty rate may apply.

Note, however, under the proposed Passive Income and Financial Intermediary Taxation Act (PIFITA) covered by House Bill. No. 304, such net gain on the sale of the stock of a NRFC will also be subject to a 15% final tax rate or treaty rate.

4. Gains realized from the sale of shares of stock listed and traded through a local stock exchange by sellers, other than dealers of securities, are exempt from the regular corporate tax, since the transaction is covered by the stock transaction tax of 6/10 of 1% of the gross selling price.

Note that under PIFITA, such percentage tax of 6/10 of 1% is proposed to be reduced annually beginning taxable year 2021 until it reaches 0% by 2026.

For accounting purposes, the gain or loss on the disposal of the FIs will always be based on the selling price against the carrying value of FIs. Such carrying value is remeasured after the initial recognition in the books due to changes to fair value, amortization, impairment or foreign exchange differences. Such gain or loss will be reported in the profit & loss statement. However, some gain or loss on the disposal may be directly reported under Other Comprehensive Income.

In the next article, we shall further discuss the details of differences in reporting both the accounting and tax perspectives of the transaction flow from: the acquisition of FIs, its subsequent measurement, and sale or disposal of the FIs.

Let’s Talk Tax is a weekly newspaper column of P&A Grant Thornton that aims to keep the public informed of various developments in taxation. This article is not intended to be a substitute for competent professional advice.

Richard R. Ibarra is a senior manager of Tax Advisory & Compliance division of P&A Grant Thornton, the Philippine member firm of Grant Thornton International Ltd.

As published in BusinessWorld, dated 19 November 2019