The BIR has been blazing ahead with its agenda of digital transformation. To recall, the BIR laid out its digital transformation plan in Revenue Memorandum Order (RMO) No. 42-2022, outlining its blueprint for the Digital Transformation (DX) Program. The program contains the BIR Roadmap for 2020–2030. The ultimate goal of the BIR DX Program is to improve tax collections through digitalization. In line with this, the BIR has been issuing several issuances. Then, the Ease of Paying Taxes (EOPT) law was signed into law, legislating for the modernization and digitalization of the BIR.

In this article, we will be focusing on the Principal and Supplementary Invoices generated with Cash Register Machines (CRM), Point-of-Sale (POS), Sales Receipting Software (SRS), and Other Sales Machines Generating Invoices/Receipts (or collectively referred to as “sales machines/software”).

In particular, the BIR issuance of RMO No. 24-2023 aligned Revenue Memorandum Circular (RMC) No. 68-2015 and RMO No. 10-2005 on the harmonization and standardization of accreditations for sales machines/software and the recent implementation of the Ease of Paying Taxes (EOPT) law through Revenue Regulations (RR) No. 07-2024. Both regulations affected the invoicing requirements for invoices generated by sales machines/software.

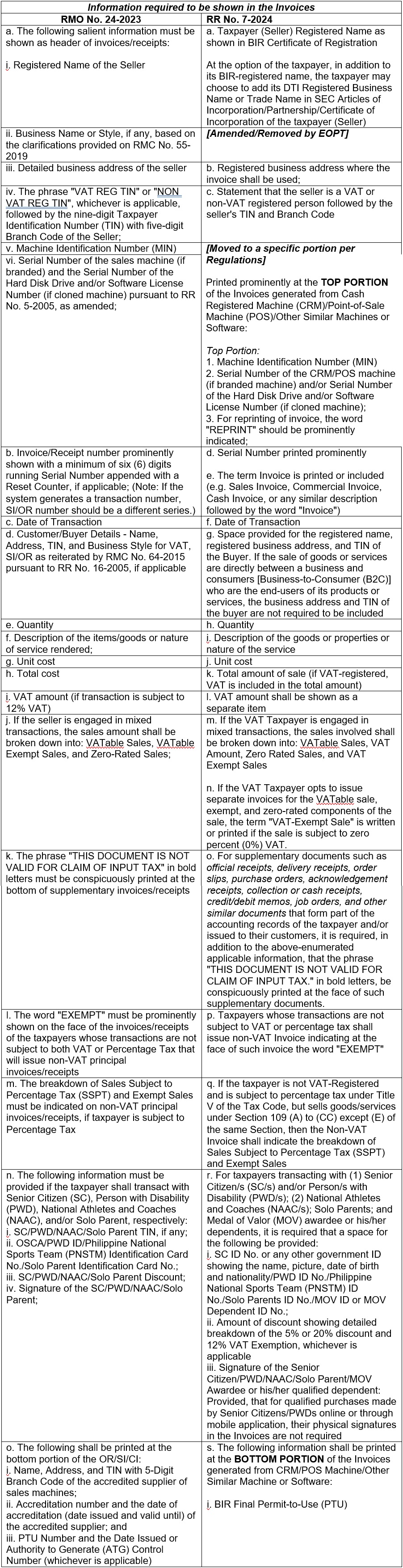

Revenue Regulations (RR) No. 7-2024 versus Revenue Memorandum Order (RMO) No. 24-2023

With these rapid changes, taxpayers ought to be reminded of the important changes in POS accreditations and the guidelines set under RR No. 7-2024 and RMO No. 24-2023. After all, non-compliance with the mandatory information to be reflected in the invoices runs the risk of disallowance of said invoices, or worse, administrative penalties and criminal liability for the taxpayer.

The matrix below shows the required information to be shown in the invoices per RR No. 7-2024 versus RMO No. 24-2023.

Are EOPT changes minor or major enhancements for sales machines/software?

Per Section 8 of RR No. 7-2024, taxpayers using CRM/POS/E-Receipting/E-Invoicing (or using sales machines/software) may change the word “Official Receipt (OR)” to “Invoice”, “Cash Invoice”, “Charge Invoice”, “Credit Invoice”, “Billing Invoice”, “Service Invoice”, or any name describing the transaction, without the need to notify the Revenue District Office(s) (RDOs) having jurisdiction over the place of business of such sales machines, since the reconfiguration is treated as a minor enhancement, which shall not require the reaccreditation of sales software/system on the part of the supplier and the reissuance of the Permit-to-Use on the part of the taxpayer-user .

On the other hand, Part IX of RMO No. 24-2023 provides that taxpayer suppliers that were granted accreditation prior to the effectivity of the regulation shall only remain valid until its expiration or if such sales machines/software have undergone enhancement. In such cases, the sales machines/software must undergo reaccreditation to check their compliance with the requirements of RMO No. 24-2023 and other revenue issuances related to the accreditation of POS.

Further, Part IV of RMO No. 24-2023 defines minor enhancements, which will only require notification to the BIR of such enhancements. Major enhancements, on the other hand, will require reaccreditation since they introduce additional functionality that is not part of the original accreditation.

However, since RR No. 7-2024 only mentioned the “change of word” of “Official Receipt” to “Invoice” (or its equivalent variants) as a minor enhancement it shall not require reaccreditation. How would sales machines/software suppliers change their existing invoice as to other requirements considering that the mandatory information per RMO No. 24-2023 is different from RR No. 7-2024? Should the taxpayers opt not to amend to avoid the risk of reaccreditation, or should the taxpayers change their POS-issued Invoice to comply with RR No. 7-2024? Are mere formatting changes to comply with RR No. 7-2024 in the POS issued Invoice deemed as a major enhancement requiring reaccreditation? As an example, the discount granted to Medal of Valor Awardees is not part of RMO No. 24-2023 and was introduced to be included under RR No. 7-2024. Does this mean that the sales machine/software supplier must create a ‘backend report’ for invoices issued to Medal of Valor Awardees similar to the ‘backend report’ for Senior Citizens to comply with the requirement under RMO No. 24-2023?

Apparently, as the BIR is still sorting out its regulations and guidelines, taxpayer-suppliers’ patience is encouraged as the BIR, along with other government agencies, pushes for modernization. Indeed, the push for digitalization and modernization of the BIR would not only serve to further strengthen the tax collection and administration of the agency but would also serve to provide convenience to the people in the near future. After all, 2030 is just six years away.

[1] This shall pertain to ‘Suppliers’ or ‘Pseudo-Suppliers’ which are taxpayer-user of “sales machines/software” who are either of the following:

(a) Direct Importer or local distributor of “sales machines/software” similar sale machines/software generating invoices/receipts.

(b) Taxpayer-users who developed their own “sales machines/software” or a local buyer of customized “sales machines/software” for their own internal use and/or for distribution to their branches, franchisees and/or related companies.

[2] This pertains to the taxpayers who bought “sales machines/software” from Accredited Suppliers.

As published in Mindanao Times, dated 09 June 2024