Executive Summary

Entities should begin preparing for IFRS 18 ‘Presentation and Disclosure in Financial Statements’ sooner rather than later (to be called PFRS 18 once adopted in the Philippines). Changes from PAS 1 ‘Presentation of Financial Statements’ could have a significant impact on the financial statements.

In April 2024, the International Accounting Standards Board (IASB) issued the new accounting standard, IFRS 18 ‘Presentation and Disclosure in Financial Statements’. Once adopted locally, this will replace the existing PAS 1 ‘Presentation of Financial Statements’ standard that has been in use for many years.

On the surface this new Standard may appear straightforward, setting out a new presentation requirement for the statement of profit or loss, and providing new definitions and disclosures related to non-PFRS performance measures. However, the details of these new requirements can lead to potential challenges that reporting entities will need to deal with to properly apply the new Standard.

While entities are dealing with a wide range of new reporting requirements, from international tax reform to sustainability reporting, changes to the presentation and disclosures of financial statements may not currently be at the top of their priorities. However, given the potentially pervasive changes brought about by IFRS 18, getting ready for IFRS 18 implementation should be prioritized.

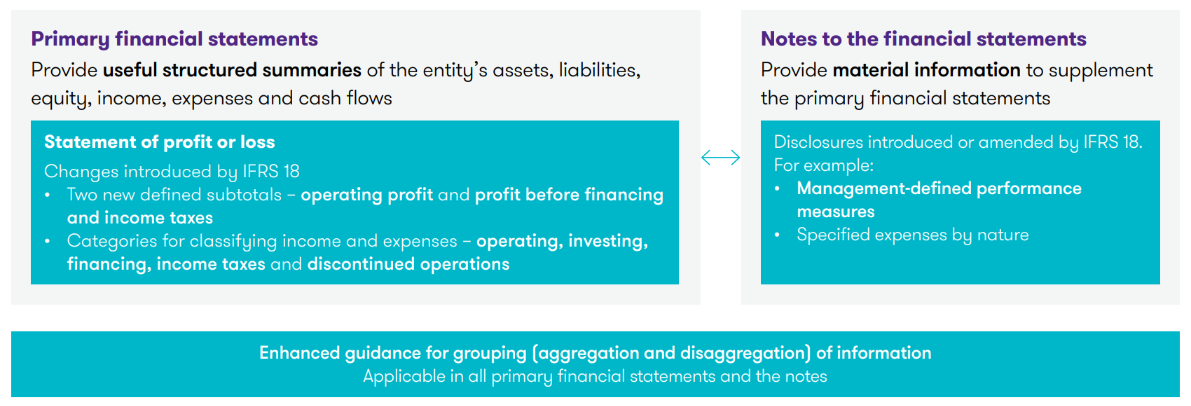

Summary of Key Changes

General requirements for the financial statements and information disclosed in the notes have been carried over from PAS 1. There are some limited changes to specific requirements for the statement of cash flows and statement of financial position, however the statement of comprehensive income and statement of changes in equity remain unchanged.

Effective Date and Transition

IFRS 18 is effective for annual reporting periods beginning on or after January 1, 2027, with earlier application permitted. Entities that early adopt IFRS 18 are required to disclose that fact in the notes.

For some entities in particular, there's a need to begin the transition early to be fully prepared for mandatory application from January 1, 2027, with retrospective restatement of comparatives.

While IFRS 18 must be applied retrospectively applying PAS 8, entities are not required to disclose the quantitative information set out in PAS 8, i.e entities do not have to disclose the amount of the adjustment to each financial statement line item or the adjustment to basic and diluted earnings per share in the current period.

For the comparative period, an entity must disclose a reconciliation between the restated amounts presented and the amounts previously presented for the comparative period applying PAS 1. This is also required for the comparative periods presented in interim financial statements prepared under PAS 34. Entities are permitted, but not required, to present similar reconciliations for the current period, as well as older comparative periods.

When first applying IFRS 18, an entity also has the option to change an election of how an investment in associate or joint venture is measured. If they are eligible to apply the exemption in PAS 28 ‘Investments in Associates and Joint Ventures’ (which applies for investments held by, or indirectly though, an entity that is a venture capital organization, mutual fund, unit trust or similar entity), an entity may change its election for measuring investments from the equity method to fair value through profit or loss in accordance with PFRS 9.

Refer to the link below for the high-level overview of IFRS 18’s new requirements, along with practical insights into the application challenges.