(Revenue Memorandum Circular No. 135-2024 issued on December 18, 2024)

This Tax Alert is issued to inform all concerned on the BIR’s circularization of R.A. No. 12066, or “An Act Amending Sections 27, 28, 32, 34, 57, 106, 108, 109, 112, 135, 237, 237-A, 269, 292, 293, 294, 295, 296, 297, 300, 301, 308, 309, 310, and 311, and Adding New Sections 135-A, 295-A, 296-A, and 297-A of the National Internal Revenue Code of 1997, as Amended, and for Other Purposes”, referred to as CREATE MORE.

CREATE MORE introduced the following amendments:

1. The corporate income tax rate applicable to registered business enterprises availing enhanced deductions was set at 20% regardless of the amount of net taxable income and total assets.

2. Basis of income exempt under treaty now includes agreements entered into by the President with economies and administrative regions, subject to the concurrence of the Senate, binding upon the Government of the Philippines.

3. List of deductions from gross income under Sec.34 of the NIRC, now includes input tax attributable to VAT-exempt sales (previously provided in revenue regulations only).

4. Additional/amended VAT Zero-rated sales:

Sale of Goods

a. Sale of raw materials or packaging materials to a non-resident buyer for delivery to a resident local export-oriented enterprise to be used in manufacturing, processing, packing or repacking in the Philippines of the said buyer's goods and paid for in acceptable foreign currency and accounted for in accordance with the rules and regulations of the Bangko Sentral ng Pilipinas (BSP);

b. Sale of goods to an export-oriented enterprise whose export sales is at least seventy percent (70%) of the total annual production of the preceding taxable year: Provided, That such goods are directly attributable to the export activity of the export-oriented enterprise: Provided, further, That the Export Marketing Bureau of the Department of Trade and Industry (DTI) shall determine compliance with the aforementioned threshold. Any export-oriented enterprise that fails to meet the threshold shall be disqualified from availing of VAT zero-rating on local purchases in the immediately succeeding year: Provided, finally, That input tax otherwise due on VAT zero-rated local purchases attributable to VAT-exempt sales shall be paid and deductible from the gross income of the taxpayer. For this purpose, 'directly attributable' shall refer to goods and services that are incidental to and reasonably necessary for the export activity of the export-oriented enterprise, including janitorial, security, financial, consultancy, marketing and promotion services, and services rendered for administrative operations such as human resources, legal, and accounting;

c. The sale of goods, supplies, equipment, and fuel to persons engaged in international shipping or international air transport operations: Provided, That the goods, supplies, equipment, and fuel shall be used for international shipping or air transport operations; and

d. Sales to bonded manufacturing warehouses of export-oriented enterprises.

Sale of Services

a. Services performed for an export-oriented enterprise whose export sales is at least seventy percent (70%) of the total annual production of the preceding taxable year: Provided, That such services are directly attributable to the export activity of the export-oriented enterprise: Provided, further, That the Export Marketing Bureau of the DTI shall determine compliance with the aforementioned threshold. Any export-oriented enterprise that fails to meet the threshold shall be disqualified from availing of VAT zero-rating in the immediately succeeding year: Provided, finally, That input tax otherwise due on VAT zero-rated local purchases attributable to VAT-exempt sales shall be paid and deductible from the gross income of the taxpayer. For this purpose, 'directly attributable' shall follow the same definition under Section 106 of this Code.

5. Additional VAT Exempt Transactions

Importation of goods by an export-oriented enterprise whose export sales is at least seventy percent (70%) of the total annual production of the preceding taxable year: Provided, That such goods are directly attributable to the export activity of the export-oriented enterprise: Provided, further, That the Export Marketing Bureau of the DTI shall determine the compliance with the aforementioned threshold. For this purpose, 'directly attributable' shall follow the same definition under Section 106 of this Code."

6. VAT Refund ProcessThe amended VAT refund process now allows submission of certified true copies of invoices and other documents in support of the application.

The Commissioner must, within the ninety (90)-day period, communicate in writing to the taxpayer, the legal and factual basis for the denial, including the deficiencies of the VAT refund claim.

The taxpayer shall have fifteen (15) days from receipt of the full or partial denial to file a request for reconsideration. The Commissioner shall decide on the request for reconsideration within fifteen (15) days from receipt thereof. Failure to file a request for reconsideration within the fifteen (15)-day period shall render the decision final.

In case of full or partial denial of the request for reconsideration, or failure on the part of the Commissioner to act on the application for refund or request for reconsideration within the periods prescribed above, the taxpayer affected may, within thirty (30) days from the receipt of the decision denying the request for reconsideration, or after the expiration of the ninety (90)-day period to decide on the application for refund, or after the lapse of the fifteen (15)-day period to decide on the request for reconsideration in cases where no action is made by the Commissioner on the request for reconsideration, appeal the decision with the Court of Tax Appeals.

7. Excise Tax Refund Process

No refund or credit of excise tax paid by suppliers on otherwise exempt sales under Section 135 shall be allowed, unless the taxpayer files a written claim for refund with the Commissioner, within two (2) years after the payment of excise tax: Provided, however, That a return filed showing an overpayment shall be considered a written claim for refund.

The Commissioner shall process and decide the refund under this provision within ninety (90) days from the submission of complete documents supporting the application filed. Should the Commissioner deny the claim for refund in full or in part, the Commissioner shall communicate in writing to the taxpayer, the legal and/or factual basis for the denial.

The taxpayer shall have fifteen (15) days from receipt of the denial to file a request for reconsideration, which shall be resolved by the Commissioner within fifteen (15) days from the receipt thereof. Failure to file a request for reconsideration within the fifteen (15)-day period shall render the decision final.

In case of full or partial denial of the request for reconsideration, or failure on the part of the Commissioner to act on the application for refund or request for reconsideration within the periods prescribed above, the taxpayer affected may, within thirty (30) days from the receipt of the decision denying the request for reconsideration, or after the lapse of the period to decide on the application for refund or request for reconsideration, in cases where no action is made by the Commissioner, appeal the decision with the Court of Tax Appeals.

8. Electronic Issuance of Invoices/Electronic Sales Reporting

In addition to the taxpayers mandated to issue electronic invoices, the Secretary of Finance, upon the recommendation of the Commissioner, may require taxpayers to issue electronic invoices.

Taxpayers who will issue electronic invoices and electronically report their sales data to the Bureau shall be granted, in addition to the allowable deduction provided under Section 34(A)(1), the following allowable deductions:

a. For micro and small taxpayers as defined under Section 21(B) of this Code, an additional deduction from taxable income of one hundred percent (100%) of the total cost for setting up an electronic sales reporting system.

b. For medium and large taxpayers as defined under Section 21(B) of this Code, an additional deduction from taxable income of fifty percent (50%) of the total cost for setting up an electronic sales reporting system.

The foregoing allowable deduction shall be availed of only once. The importation of such electronic sales reporting system shall also be exempt from taxes.

9. Tax Incentives

Extent of Authority to Grant Tax Incentives

IPAs no longer acting under a delegated authority from the FIRB; Matters pending with the FIRB immediately referred to the concerned IPA.

Granting tax incentive shall take into consideration the following:

a. Infusion of Investment Capital

b. Generation of Direct Local Employment considering the R.A. No. 11962

c. Other standard and project specific performance metrics of the registered activity that may be imposed by FIRB of concerned IPA

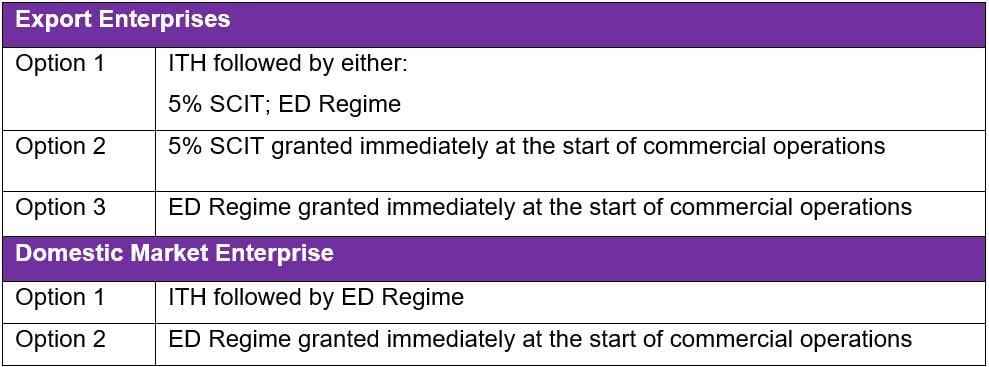

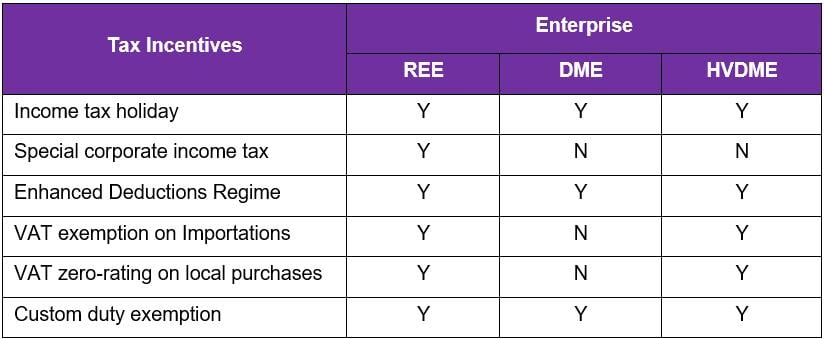

Incentives

For export enterprise, 5% SCIT based on gross income earned is in lieu of all national and local taxes, and local fees and charges.

Duty exemption on importation of capital equipment, raw materials, spare parts, or accessories including used for administrative purposes of the registered activity.

RBE Local Tax

In lieu of all local taxes and local fees and charges imposed by the LGU, the LGU may impose an RBE local tax of not more than 2% of RBE’s gross income during ITH and EDR.

The RBE local tax shall not be imposed on RBEs under SCIT.

For two or more LGUs of the same RBE: 50% of revenues shall be shared equally among the LGUs; 50% of revenues shall be apportioned based on the population of LGUs.

LGUs may reduce or waive the rate of tax, or their share thereof in the case of two or more local government units covering the same enterprise.

Availment of Tax Incentives

Conditions on Availment of Enhanced Deductions

1. The depreciation allowance of the assets acquired for the entity's production of goods and services (qualified capital expenditure) shall be allowed for assets that are directly related to the registered enterprise's production of goods and services other than administrative and other support services.

2. The additional deduction on the labor expense shall not include salaries, wages, benefits, and other personnel costs incurred for managerial, administrative, indirect, labor, and support services.

3. The additional deduction on research and development expense shall only apply to research and development directly related to the registered project or activity of the entity and shall be limited to local expenditure incurred for salaries of Filipino employees and consumables and payments of local research and development organizations.

4. The additional deduction on the labor expense shall not include salaries, wages, benefits, and other personnel costs incurred for managerial, administrative, indirect labor, and support services.

5. The additional deduction on domestic input expense shall only apply to domestic input that are directly related to and actually used in the registered export project or activity of the registered business enterprise.

6. The additional and increased deductions on power expense shall only apply to power utilized for the registered project or activity.

7. The deduction for reinvestment allowance to manufacturing and tourism industries shall only be availed until December 31, 2034.

8. The additional deduction on expenses relating to trade fairs, exhibitions or trade missions shall include expenses incurred in promoting the export of goods or the provision of services to foreign markets.

RBE Taxpayer Service

RBE Taxpayer Service is a separate service or unit within the BIR for RBEs.

The Commissioner shall prescribe the manner and place of filing of returns and payments of taxes by RBEs through the said service or unit to simplify filing and payments processes.

Conditions for Extension of Availment

1. 10,000 direct local employees are employed in the registered activity

2. Maintains the said number during its registration

Maximum years of extension

Projects approved by IPA – 5 Years

Projects approved by FIRB – 10- Years

Expansion of Registered Activity

A qualified expansion may qualify to avail:

a. Approved by IPA

REEs – EDR/5%SCIT for 8 years

DMEs – EDR for 8 years

The registered activities/projects prior to effectivity of CREATE may qualify to register on or before December 31, 2024

b. Approved by IPA

REEs – EDR/5%SCIT for 13 years

DMEs – EDR for 13 years

The registered activities/projects prior to effectivity of CREATE MORE may qualify to register and avail the incentives granted under the CREATE MORE.

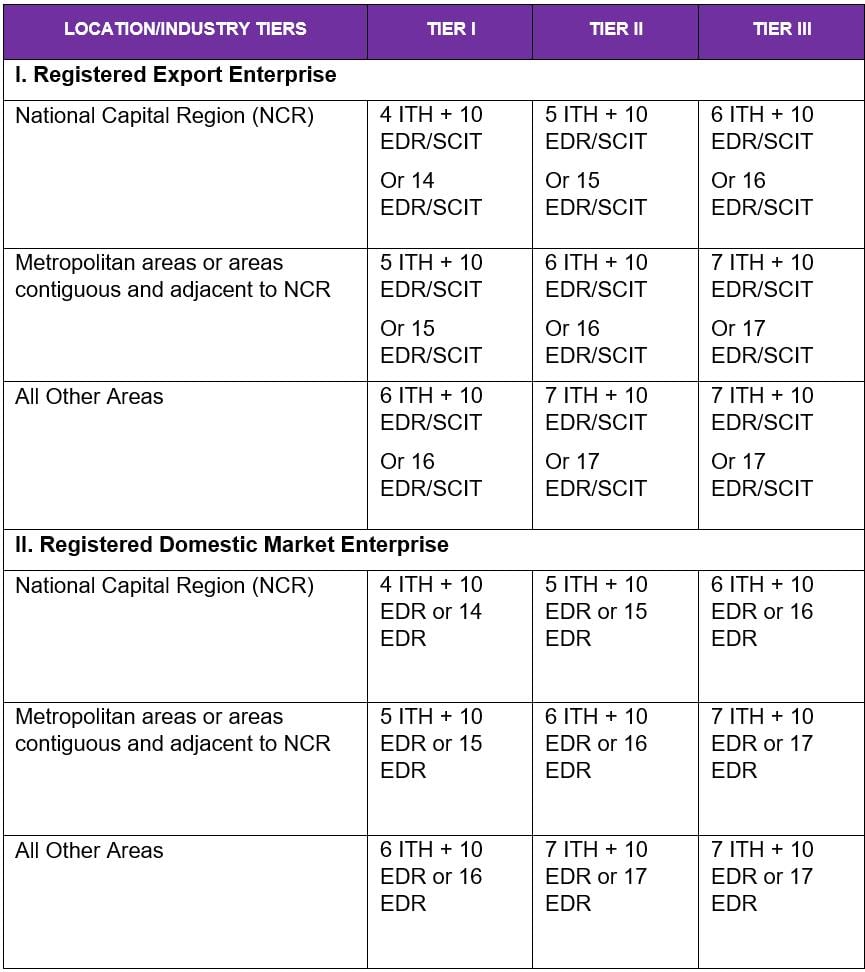

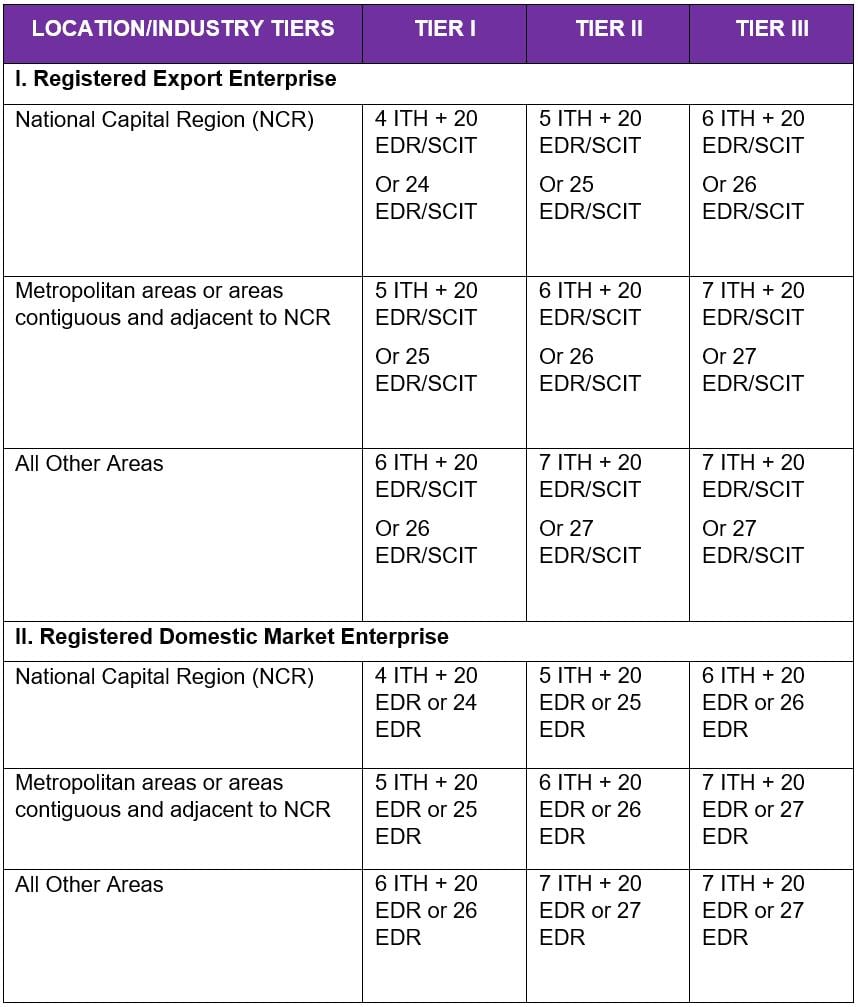

REVISED PERIOD OF AVAILMENT BASED ON INDUSTRY TIERS/LOCATION (APPROVED BY IPA)

REVISED PERIOD OF AVAILMENT BASED ON INDUSTRY TIERS/LOCATION (APPROVED BY FIRB)

Additional Incentives

Projects or activities of registered enterprise in areas recovering from armed conflict or a major disaster shall be entitled to 2 additional years of income tax-based incentives.

Projects or activities registered prior to the effectivity of CREATE MORE or under the incentive system provided herein that shall, completely relocate from the NCR shall be entitled to 3 additional years of income tax-based incentives.

Processing of Incentives Application

FIRB and IPA shall issue a decision on application for tax incentives within 20 working days from receipt of all required documents.

Extension of the processing period

-Can only be extended once

-Maximum of additional 20 working days

Power of the President to Grant Incentives

The President may, in the interest of national economic development, OR upon recommendation of the FIRB, modify the mix, period and manner of availment of incentives or craft appropriate fiscal and non-fiscal support package for a highly desirable project or specific industrial activity.

Non-fiscal support is limited to use of land, and budgetary support

Suspension of Power: UNMANAGEABLE fiscal deficit

Operations of Registered Activities or Projects in Geographical Zones

RBEs may institute Telecommuting Program which includes WFH Arrangement of less than or equal to 50% of the total workforce

CREATE MORE Incentives Applicable to Registered Activity Before CREATE MORE

a. The exemption from national and local taxes including local fees and charges for projects or activities availing SCIT

b. The availment of additional enhanced deductions

c. The imposition of 20% income tax rate

d. The imposition of RBE local tax

e. The conditions for the availment of duty and VAT exemption on importation and VAT zero-rating on local purchases

Effectivity Date

The Republic Act took effect fifteen (15) days after its publication in the Official Gazette or in a newspaper of general circulation. The Act was published in the Official Gazette last November 12, 2024.