(Revenue Regulations No. 002-2025 issued on January 08, 2025)

This Tax Alert is issued to inform all concerned on the implementation of the tax provisions of Sections 27 to 34 of Title IV of Republic Act (RA) No. 9267, otherwise known as “The Securitization Act of 2004.”

The Securitization Act of 2024 aims to promote the development of the capital market by creating a favorable market environment for a range of asset-backed securities. The Act provides legal and regulatory framework for securitization. It rationalizes the rules, regulations, and laws that impact upon the securitization process, particularly on matters of taxation and sale of real estate on installment.

To implement the tax provisions of Sections 27 to 34 of Title IV of the Act, the BIR issued RR No. 02-2025.

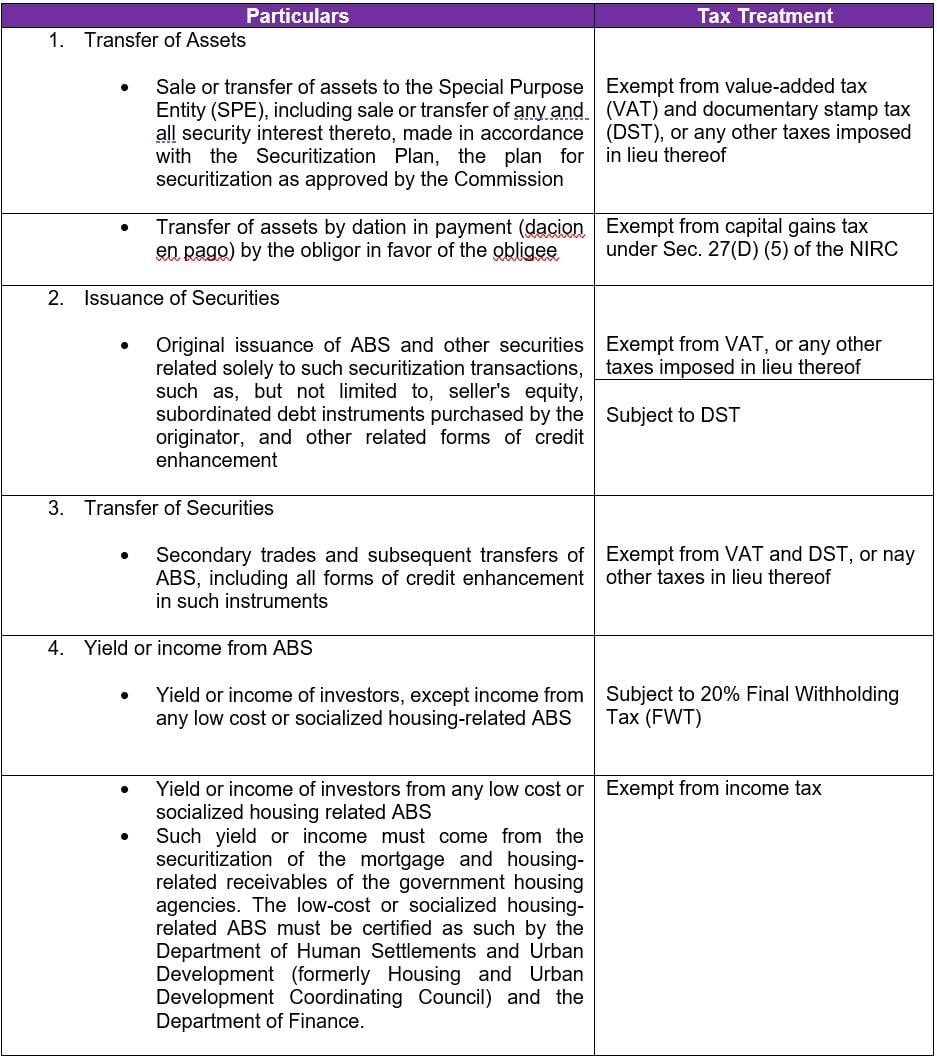

Pursuant to RA No. 9267, as implemented by RR No. 02-2025, the following tax treatment shall apply to transfer of assets, issuance and transfer of securities and income from asset backed securities (ABS):

Definition of Terms

- “Securitization” means the process by which assets are sold on a without recourse basis by the Seller to a Special Purpose Entity (SPE) and the issuance of asset-backed securities (ABS) by the SPE which depend, for their payment, on the cash flow from the assets so sold and in accordance with the Securitization Plan.

- “Asset-backed securities (ABS)” refer to the certificates issued by an SPE, the repayment of which shall be derived from the cash flow of the assets in accordance with the Securitization Plan.

- “Assets,” whether used alone or in the term “Asset-backed securities,” refer to loans or receivables or other similar financial assets with an expected cash payment stream. The term “Assets” shall include, but shall not be limited to, receivables, mortgage loans and other debt instruments: Provided, That receivables that are to arise in the future and other receivables of similar nature shall be subject to approval by the Securities and Exchange Commission (SEC) or the Bangko Sentral ng Pilipinas (BSP), as the case may be: Provided, further, That the term “Assets” shall exclude receivables from future expectation of revenues by government, national or local, arising from royalties, fees or imposes.

- “Credit Enhancement” means any legally enforceable scheme intended to improve the marketability of the ABS and increase the probability that the holders of the ABS receive payment of amounts due them under the ABS in accordance with die Securitization Plan.

- "Securitization Plan" means the plan for securitization as approved by the Commission.

Repealing Clause

Any inconsistent rules and regulations are revoked, repealed, or amended accordingly.

Effectivity

The regulations take effect fifteen days following its publication in the BIR Official Website.