(Revenue Regulations No. 03-2025, January 17, 2025)

This Tax Alert is issued to inform all concerned on the policies and guidelines for the implementation of the 12% value added tax (VAT) on digital services pursuant to Republic Act (RA) No. 12023.

According to RA No. 12023, a 12% VAT will be imposed on digital services consumed in the Philippines, whether provided by resident or nonresident digital service providers (DSPs).

I. Covered Persons

Digital service provider refers to an individual or juridical, resident or non-resident supplier of digital services to a buyer who uses the digital services in the Philippines. Nonresident DSP refers to a DSP that has no physical presence in the Philippines.

II. Covered Transactions

1. Digital services. This refers to any service that is supplied over the internet or other electronic network with the use of information technology and where the supply of the service is essentially automated. It shall include, but not limited to:

a. Online search engine

b. Online marketplace or e-marketplace

c. Cloud service

d. Online media and advertising

e. Online platform

f. Digital goods

g. Cloud and IT infrastructure, such as data storage, and web hosting

h. E-commerce platforms and payment processing

i. Targeted digital marketing and analytics

j. Communication tools and collaborative software

k. E-learning platforms and professional networking

l. Data analytics and artificial intelligence for business insights

m. Cybersecurity and regulatory compliance

n. Masking and encryption services (e.g., virtual private network services)

o. Online consultations through a digital platform (i.e., website, applications, e-marketplace)

p. Interactive media, like online gaming, and augmented and/or virtual reality (AR/VR) experiences

2. Digital goods. This refers to intangible goods that are delivered or transferred in digital form, including sounds, images, data, facts or combination thereof. These digital goods include, but are not limited to the following:

- Digital content purchases (e.g., download of e-books, music, videos, software, applications, digital media, e-games, and online courses)

- Subscription-based supplies of content (e.g., news, music, streaming media, online gaming, online courses)

- Digital art

- Supplies of software services and maintenance (anti-virus software, digital data storage, etc.)

- Licensing of content (e.g., access to specialized online content such as publications and journals, software, cloud-based systems, etc.)

- Telecommunication and broadcasting services

- Virtual assets

The VAT on digital services does not cover the sale, supply, or deliver of physical goods from a foreign territory to a consumer, user, or buyer in the Philippines, it being an importation of goods subject to customs duties, taxes, such as VAT or excise taxes, and other charges under RA No. 10863, and other applicable laws, rules, and regulations.

III. Transactions not covered by VAT on digital services

The following digital services are exempt from 12% VAT:

a. Educational services such as online courses, online seminars, and online trainings, rendered by private educational institutions, duly accredited by the Department of Education (DepEd), the Commission on Higher Education (CHED), the Technical Education and Skills Development Authority (TESDA), and those rendered by government educational institutions

b. Sale of online subscription-based services to DepEd, CHED, TESDA, and educational institutions recognized by said government agencies; and

c. Services of bank, non -bank financial intermediaries performing quasi-banking functions, and other non-bank financial intermediaries rendered through different digital platforms. This includes Virtual Asset Service Providers (VASPs) registered and classified by BSP as Non-Bank Financial Institutions.

Other VASPs, including business involved in the participation and provision of financial services related to issuer’s offer and/or sale of a Virtual Asset shall be subject to the provisions of the Act and RR No. 03-2025.

IV. Registration Requirements for DSPs

a. Nonresident DSPs

Nonresident DSPs shall register with the BIR within the period prescribed under Section 236 of the Tax Code through the VAT on Digital Services (VDS) Portal.

Nonresident DSPs with current covered transactions shall register with the BIR within the 60 days from the effectivity of RR No. 03-2025 through VDS Portal and submit the prescribed information therein.

Appointment of local representative/service provider

The nonresident DSP does not need to have a local representative in the Philippines. It may appoint a resident third-party service provider for purposes receiving notices, record keeping, filing of tax returns, and other reporting obligations. Upon appointment of the third-party service provider, the non-resident DSP shall notify the BIR in writing of the same within thirty (30) calendar days.

The appointment of a service provider shall not classify the nonresident DSP as a nonresident foreign corporation doing business in the Philippines.

b. Resident DSPs

The resident DSPs shall register with the BIR following the policies and procedures under Section 236 of the Tax Code and other existing relevant laws, rules, and regulations.

V. Gross sales of DSP Subject to 12% VAT

There shall be 12% VAT imposed on the gross sales derived by a DSP from its supply or delivery of digital services by DSPs consumed in the Philippines.

The following information, among others, may be used to determine whether the digital service is consumed or used in the Philippines:

a. Payment information (e.g., credit card information, bank account details); or

b. Residence information of the buyer (e.g., home address, billing address); or

c. Access information (e.g., mobile country code of SIM card, Internet Protocol address); or

d. Any other information to establish the most reliable determination of the buyer’s location (e.g., business agreement, predominant place of consumption, language of digital content supplied)

Gross Sales in Foreign Currency

In case the service payment is in foreign currency, the DSP shall convert the payment into Philippine Peso currency using:

1. The spot rate of exchange on a daily or a monthly basis using the average exchange rate during the month based on the Banker’s Association of the Philippines (BAP) published rates; or

2. In the event that the BAP published rate is impractical or not feasible, the daily spot rate or monthly average rate based on other available exchange rates (BSP, Bloomberg, Reuters exchange rates, etc.) shall be used subject to the following conditions:

a. A taxpayer electing to use forex rates other than BAP published rates shall state the reason in the VAT on Digital Services (VDS) Portal for using a source other than BAP published rates, and allow the BIR to have an access on the day-to-day or monthly average foreign exchange rates for verification and validation.

b. The source of the foreign exchange rates used in converting foreign currency-denominated transactions, such as the URL/source where the foreign exchange rates are published or listed or a summary of the day-to-day or monthly average exchange rates to be used for the taxable year must be available for submission, together with other supporting documents during BIR verification and validation.

The election of the basis of conversion is irrevocable and must be used consistently in reporting for tax purposes for at least one (1) taxable year. The Commissioner of Internal Revenue may, however, prescribe the acceptable conversion rates to be used and specify when those rates shall be applied.

VI. Invoicing and Accounting Requirements of DSPs

The resident VAT-registered DSPs shall issue sales or commercial invoices for every sale, barter, or exchange of digital services under Sec. 113 of the Tax Code.

On the other hand, nonresident VAT-registered DSPs shall indicate the following information in the invoice in lieu of the requirements under Sec. 113 (B) paragraphs 1-4 of the Tax Code:

- Date of transaction;

- Transaction reference number;

- Identification of the buyer (including the TIN, if any);

- Brief description of the transaction;

- Total amount with indication that such amount includes VAT; and

- Breakdown of sales (subject to VAT, VAT-exempt, or VAT zero-rated) and the VAT on each portion of the sale

Nonresident digital service providers can issue electronic invoices without BIR registration or authority to print (ATP). The invoices must be in English or have an English translation and include all required details.

Nonresident DSPs classified as an online marketplace or e-marketplace shall also issue the relevant sale or commercial invoice following the rules prescribed for nonresident VAT registered DSPs.

The requirement to maintain subsidiary sales journal and purchase journal in which daily sales and purchases are recorded shall not apply to nonresident VAT-registered DSPs.

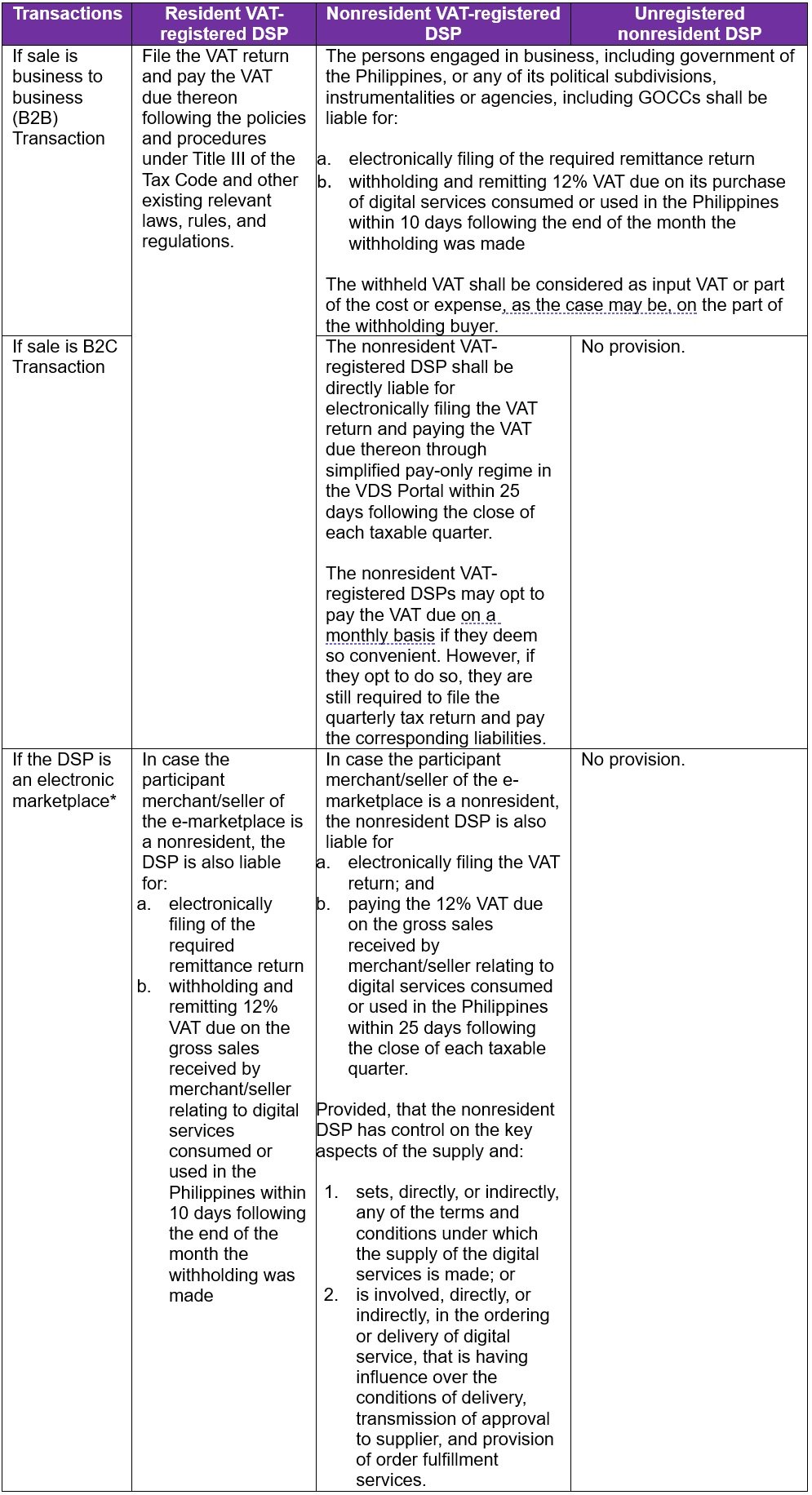

VII. Filing of tax returns and payment and remittance of VAT

*Electronic marketplace (e-marketplace) refers to a digital service platform whose business is to connect online sellers or merchants, facilitate and concludes the sales, process the payment of the digital services through digital platform, or facilitate the post-purchase support within the platforms, while retaining oversight over the consummation of the transaction.

The DSPs and the Philippine buyers are required to determine whether or not its contracting party is engaged in business and may rely on the document on the documents and/or information (e.g., TIN) submitted by its contracting party and shall be absolved from any tax liability, absent any fraud or negligence on the part of such relying party.

In cases where a nonresident VAT-registered DSP, acting in good faith and having made reasonable efforts to obtain the appropriate evidence, is unable to establish the status of its buyer, it shall be presumed that its buyer is not engaged in trade or business, in which case, the nonresident VAT-registered DSP shall file and remit or pay the tax due, pursuant to the prescribed rules and procedures above.

There shall be interest, surcharge, and penalties imposed in case of late filing or payment of tax returns.

Nonresident VAT-registered DSPs shall not be allowed to claim creditable input tax.

Conduct of Post-Audit and Verification by the BIR

All the parties to the B2B and B2C transactions that are within the taxing jurisdiction of the Philippines shall be subject to post-audit and examination by the BIR.

Suspension of Business Operations

Upon verification that any the DSP fails to: a) register its business with the BIR; b) comply with the provision of these Regulations, the CIR or his duly authorized representative has the authority to issue a Closure or Take Down Order to close the business operations.

The Closure or Take Down Order includes blocking of digital services performed or rendered in the Philippines by a DSP which shall be implemented by the Department of Information and Communication Technology, through the National Telecommunications Commission.

The closure of business operations under a duly approved Closure or Take Down Order shall not preclude the BIR from filing the appropriate administrative and criminal sanctions against the persons concerned if evidence so warrants, or in the case of juridical entities, against its responsible officers, under Run After Tax Evaders (RATE) Program of the BIR.

Penalties

Any violations of provisions of these Regulations shall be subject to the imposition of penalties and institution of appropriate criminal, civil, and administrative charges against erring DSPs and their responsible offices under the Tax Code, existing laws, rules, and regulations.

Transitory Provisions and Effectivity

All nonresident DSPs required to register shall register or update with the BIR within sixty (60) days from the effectivity of these Regulations through the VDS Portal and shall immediately be subject to VAT after 120 days from the effectivity of these Regulations.

This issuance shall take effect fifteen (15) days following its publication in the Official Gazette or the BIR’s official website, whichever comes earlier. Per BIR’s official website, RR No. 03-2025 was posted on January 17, 2025.