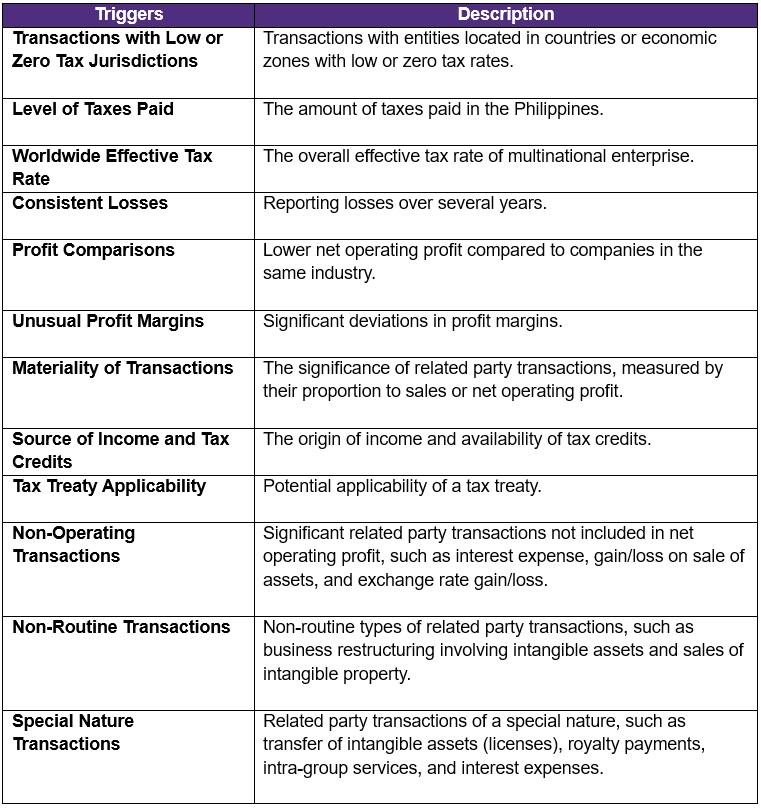

Transfer pricing audit triggers are specific factors or indicators that prompt tax authorities to initiate a risk assessment on a company’s related party transactions. These triggers help tax authorities identify potential non-compliance with transfer pricing regulations.

Key points

(Revenue Audit Memorandum Order No. 1-2019)

Stay vigilant and ensure compliance with transfer pricing regulations by understanding and addressing these audit triggers. Proper documentation and adherence to the arm's length principle can help mitigate the risk of audits and potential penalties. Proactively manage your transfer pricing practices to maintain transparency and integrity in your business operations.

Copy text of article